BASIC INTRODUCTION

When it comes to the cryptocurrency trading space, traders are usually faced with varieties of trading limitations. Prominent amongst these is getting an easy trading access to platforms that offer an exchange of a variety of altcoins. This especially does turn off risk-loving traders who love to try out different coins. They find it hard to convert these altcoins as well-known exchange platforms do prioritize listing of the more established coins over the less valued coins.Another major turnoff is the compulsory registration required to use these exchange platforms. This doesn't only take away the transaction anonymity privileges from the trader, many platforms do require the traders to provide proof of identity before funds transfer services can be possible. Other times, more complex procedures are usually involved.

Summing all these, noobs and even established traders are easily discouraged from actively investing in a variety of coins. Especially because many exchange platforms also require a great deal of technical know-how to use the trading interface.

What is CurioInvest’s

CurioInvest’s mission is to form it attainable for everybody to invest in rare collectable vehicles. It is based in Swiss Confederation and Lichtenstein Region, CurioInvest is launching a web platform powered by blockchain technology that allows investors to buy security tokens directly backed by edition collectable cars. These tokens permit investors to share within the profit if the worth of the underlying vehicle will increase.

In this method, CurioInvest is eliminating the barriers to entry to the collectable car market. As a half stake in an exceeding vehicle may be purchased on-line for as very little as $500, the minimum investment required to enter the market is dramatically lowered, it enables the investors to diversify they into by purchasing stakes in multiple vehicles.

Problem Identified

According to the Knight Frank Luxury Investment Index, over the 10 years up to Q2 2018, collectable vehicles offered a return on investment of 289%. The asset class outperformed all other alternative investments under review over this period, including coins (182%), wine (147%), jewellery (125%), and watches (73%).

Despite the size and attractiveness of this asset class, only a small group of elite investors have had the resources necessary to overcome the barriers to entry to the market:

The barriers discussed above preclude the majority of investors and car enthusiasts from participating in the collectable car market. Even for wealthy investors, however, the current market features high transaction costs and limited options for diversification:

The CurioInvest team has a proven track record of profitably trading investment-grade cars at Mercuria Helvetica AG and has access to a pipeline of over 500 rare, collectable vehicles. Besides, CurioInvest has partnered with Mechatronik GmbH to store and maintain the vehicles.

The CurioInvest Invest platform will bring unprecedented transparency, security and liquidity to a market that was previously only accessible to elites. Ultimately, CurioInvest aims to become the Nasdaq of collectable vehicles, hosting an exchange where automotive security tokens can be traded in near real-time.

Why Choosing CurioInvest?

CurioInvest is well-positioned for the following reasons:

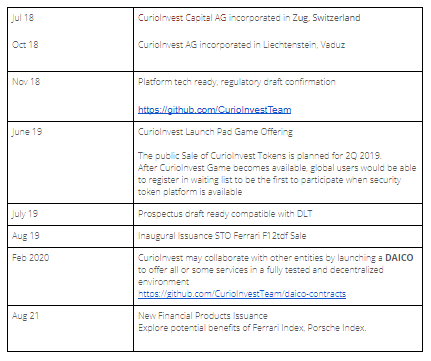

ROADMAP

MEET THE AMAZING TEAM

Official Link:

White: https://curioinvest.com/

Whitepaper: https://docs.google.com/document/d/16RBxiuPNhG7DkvTx9odzcQvPc9EdTKnmKaohURxrLTA/edit#

Telegram: https://t.me/curiocarQA

Twitter: https://twitter.com/curio_invest

Whitepaper: https://docs.google.com/document/d/16RBxiuPNhG7DkvTx9odzcQvPc9EdTKnmKaohURxrLTA/edit#

Telegram: https://t.me/curiocarQA

Twitter: https://twitter.com/curio_invest

Author: KanekiKov

My BitCointalk profile: https://bitcointalk.org/index.php?action=profile;u=2432648;sa=summary

My ETH: 0xACE2d47039C296a158e6EE1827300e6B098B9B0B

0 komentar:

Posting Komentar